FINRA CAT recently hosted a 2-part webinar focusing on industry releases and guidance related to the Customer and Account Information System (CAIS).

Part 1 of the webinar series focused on details related to an upcoming, one-time delivery of outstanding rejections as well as the expansion of the correctionList to include a correctionAction of ‘DELETE’ for all Data Validation Errors. During the presentation, FINRA CAT also provided a refresher on the FDID validations in the Transaction system against FDIDs in the CAIS system.

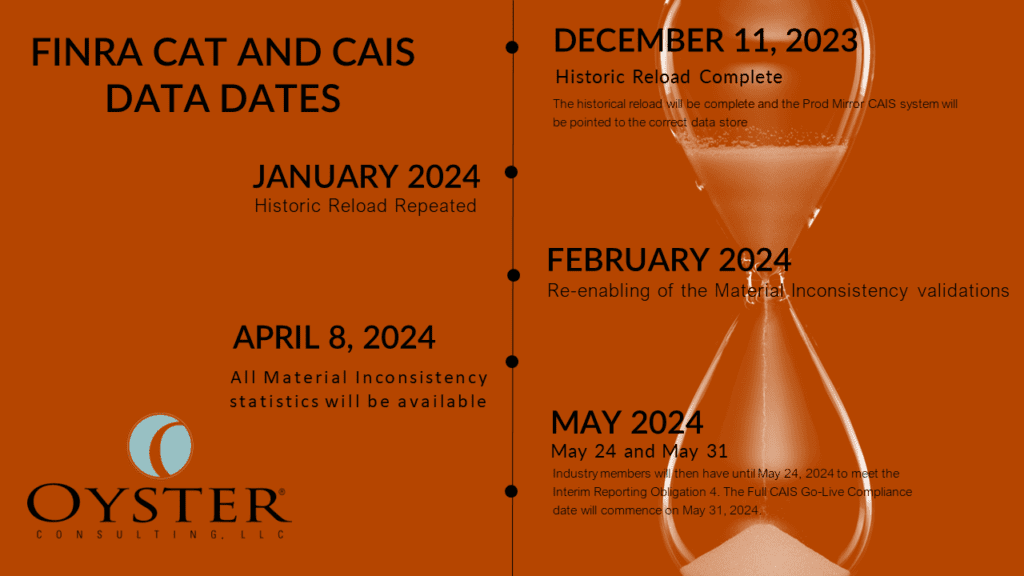

Part 2 focused on the re-enabling of the Material Inconsistency validations, including a one-time historical scan, their simplified approach and resolution of errors, and a discussion about the new data schemas industry member need to prepare to ingest.

It is well-known that FINRA CAT experienced significant data load issues in October of 2022. These issues continued to impact the plan provider, and therefore all industry members, until June of 2023, at which time all data files and errors were being loaded properly in the CAIS system.

This required FINRA CAT to rebuild the CAIS database and replay a significant amount of data for accuracy. It should be noted that there are no actions that industry members need to take to allow FINRA CAT to process these changes. However, the plan provider will be delivering a one-time outstanding rejection file and a one-time historical scan for material inconsistencies. These files were delivered to industry members in a new schema published on November 30, 2023. This schema is expected to be leveraged in the daily validations, including a more streamlined approach to material inconsistencies.

CAIS Timeline

Actions Industry Members Should Take

Encourage key CAT/CAIS stakeholders to familiarize themselves with the information presented by FINRA CAT during the latest webinars.

If a firm employs a CAT Reporting Agent (CRA), perform the necessary due diligence on the provider to ensure their preparedness as it related to the newly published data schemas required for the CAIS release.

Prepare for the expansion of the correctionList in February of 2024. This will provide industry members the ability to use a correctionAction of “DELETE” to resolve validation errors. For example, a firm may have over-reported in the past or where there was a mis-match Customer Type and TID value; they would be able to use the DELETE correctionAction to resolve the validation error.

Develop desk procedures to resolve additional FDID validations performed by FCAT in February of 2024. This will compare FDID values reported on New Order events in the CAT transaction system to FDID values reported to the CAIS database and provide anomalies.

Determine how the firm will supervise, monitor, and potentially repair Material inconsistencies, starting in February of 2024. The new streamlined process will eliminate previous specifications. Industry members will be required to act on any Intra or Inter-Firm Material inconsistencies. This should include repair/resolution plans for both the one-time historical re-load as well as the daily error file.

Proactively update firm Written Supervisory Procedures, Desk Procedures and Supervisory Controls related to CAT/CAIS.

Report to management any known issues or deficiencies that may impact firm reporting to CAT/CAIS.

Oyster Consulting’s Consolidated Audit Trail experts use their deep regulatory experience in trade reporting to help firms achieve their CAT reporting obligations and get the most out of their CAT reporting investment. Leverage our expertise and CAT reporting software to ensure your reporting meets regulatory requirements.

Oyster Consulting’s proprietary Consolidated Audit Trail reporting software includes a CAIS module that can be utilized by firms who do not use the CAT Application for monitoring and evidencing their CAT reporting. Our software consolidates CAT reporting events, error analysis and validation data into a central program. The CAT Application then will identify errors, linkage and gaps between vendor data and CAT reported data.