FINRA CAT Reporting Deadlines Approach

Navigating the Compliance Home Stretch

By Ralph Magee

Subscribe to our original industry insights

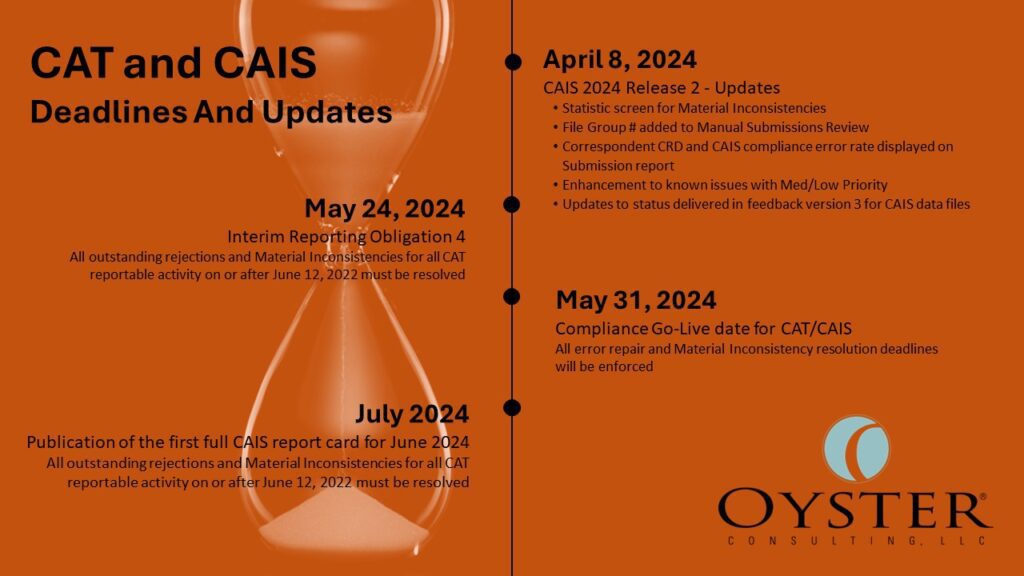

As they approach the final compliance deadline in the multi-year implementation of the Consolidated Audit Trail (CAT), broker-dealers are encountering significant challenges in meeting reporting requirements.

CAT Reporting Challenges and Observations

Based on the latest data shared by FINRA CAT (FCAT) during the latest CAIS update call on March 27, 2024, the industry is exceeding the overall daily initial submission error rate of 5% on a regular basis. As expected, similar statistics were also reported for daily FDID and Customer submission rates. Although FCAT noted that the error rate on T+3 dropped, this is still concerning given the amount of time industry members have to comply. The data also fails to provide any insight into how the industry is performing on Material Inconsistencies.

Noted FCAT Rejections Observations

File rejects

- Unauthorized CAT Submitter ID

- Duplicate File

- Missing or Invalid fdidRecordCount

FDID rejects

- Associated Customer Record rejected

- Unknown Field Name

- Multiple active roles for Customer within fdidCustomerList

- Missing or Invalid roleEndDate

- Missing ‘ADDRESS1’ type Address Record on the FDID Record

Customer rejects

- Customer Record rejected because an associated FDID was rejected

- Malformed TID Record – CAT Customer Record not processed

- Missing or Invalid format of yearOfBirth

- Missing or Invalid firstName

3700 Series errors

Oyster Consulting’s experts are assisting clients and speaking with Industry Members that have experienced more than expected 3700 Series CAT errors, which indicate accounts have CAT transactional activity, but that the associated account is not found in CAIS. Provider defects, over-reporting and outstanding rejects have been the majority of these exceptions.

Addressing CAT and CAIS Reporting Challenges

CAT Compliance Consulting

Oyster Consulting provides comprehensive consulting for CAT and CAIS reporting, from performing simple due diligence on CAT Reporting Agents to providing a comprehensive assessment of your CAT/CAIS reporting and related policy, procedures and controls.

Oyster Solutions CAT Reporting Software

Oyster Solutions Consolidated Audit Trail reporting software helps firms meet their FINRA CAT reporting obligations.

The Oyster Solutions CAT Reporting Module consolidates CAT reporting events, error analysis and validation data into a central program. Our CAT Application will identify errors, linkage and gaps between your data and CAT reporting data. Our application allows for individual and bulk repairs prior to the FINRA CAT Portal, a feature that enhances the user experience. The Oyster Solutions CAIS module can be utilized by firms who do not use the CAT Application for monitoring and evidencing their CAT reporting.