CAT Goes Live Part 2: What Should My Firm Be Doing?

By Ralph Magee

Subscribe to our original industry insights

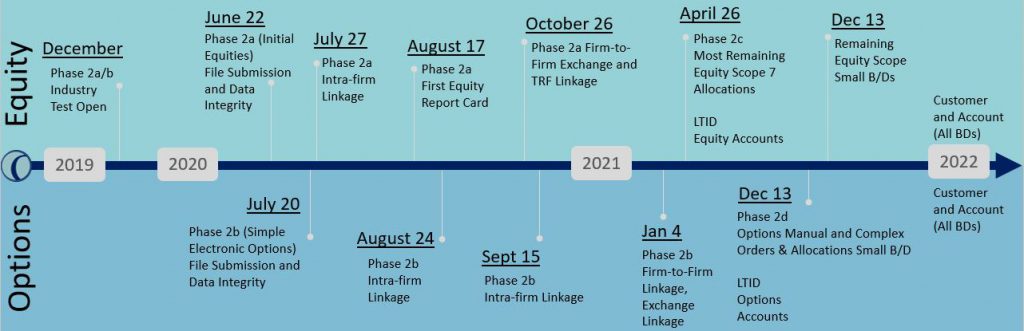

As a continuation of last week’s update on CAT activity, we will dive into more detail regarding a few panel comments regarding upcoming milestones found on the compliance timeline.

As we pointed out last week, it has been a remarkable achievement for the industry to have arrived at the compliance implementation for the CAT with Phase 2a (Equity) commencing next week, and Phase 2b (Options) on July 20th. However, firms should remain focused as we move into the following phased implementations.

Linkage

Linkage will come in three stages:

- Intrafirm

- Interfirm (Firm-to-Firm)

- Exchange/TRF Linkage

Industry members have the most control over the Intrafirm phase and will have the greatest access to data and resources to repair any rejections. To stay compliant, your firm must make any rejected event repairs before T+3 at 8am ET, this after feedback files for linkage aren’t available until around 12 noon on T+1. As the phases progress, firms will have additional dependencies to repair any rejects with other firms or exchanges. The panel expressed how important it is for firms to be ready to repair rejects efficiently. Firms are encouraged to start putting together contact lists for counter parties as well as operational leads. Though your firm may have some familiarity with reporting from OATS, this may be an entirely new requirement for some firms you may do business with daily. Working with your counterparties now to establish communication lines will pay dividends and mitigate the risk of another firm potentially increasing your rejection rate or compromising your compliance.

Large Trader Reporting (LTID)

Simply put by one panelist, “LTID is bigger than a breadbox.” It is critical that firms outline the LTID reporting rules and prepare their firm’s operations team as LTID is absorbed into CAT reporting. This is a great time for firms to reach out to all their advisors to confirm existing accounts as Larger Traders in addition to reviewing their current policies and procedures for monitoring accounts which could be identified as an Unidentified Large Traders. Also, consider reaching out to your vendors, whether back office providers or OMS/EMS firms, to make sure you review all reporting scenarios required.

Phase 2c (Equity) and Phase 2d (Options)

These phases not only bring new concepts but additional complexities. The panel cautioned that there is a great amount of detail that will likely require substantial refactoring of work during 2a/2b. Phase 2c will introduce Allocation reporting, allowing SROs to gain access to data previously reported to blue sheets. It is important to note that Allocation reporting not only includes the generally accepted understanding of allocating client trades from a larger or bunched transaction, but also will include the final booking of shares to all clients for individual trades.

Firms need to prepare for enhancements to Linkages, Representative Orders, External Routes, Special Handling instructions, just to highlight a few. Options reporting will also significantly change with the reporting of manual options, electronic and manual paired orders as well as call complex options order flow with linkages to all CAT-reportable legs.

Each of these phases will be preceded by a testing window allowing firms to validate reporting. It is essential for project owners to monitor and understand how their firm or reporting vendors are positioning themselves for future updates. We strongly encourage our clients to develop, update and initiate a project plan which incorporates all of these workstreams.

Oyster can help you assess how your firm is positioned for CAT readiness, manage your requirements assessment and implementation phases, interface with your own technology providers, and assist you in determining what and how your technology providers will report for you. We can also assist in testing data scenarios and data linkage, as well as creating an error repair process. Firms can also leverage Oyster testing tools to gather and analyze reported data and errors.