Better than a bird’s eye view – see the forest AND the trees. Housing the foundation of the tool’s trade compliance and supervision function, Monitor is the foundation for trade review. Your surveillance, supervision and testing needs are met with Oyster Solutions’ powerful trade blotter. Evidence your reviews with notes and electronic sign off to document supervision and document testing for rule compliance and regulatory requirements.

Oyster Solutions Monitor Module

Trade Supervision and Surveillance Compliance Tool

Conquer Your Supervision Gaps – View Our Demo Now

Monitor keeps your surveillance and trade supervision compliant

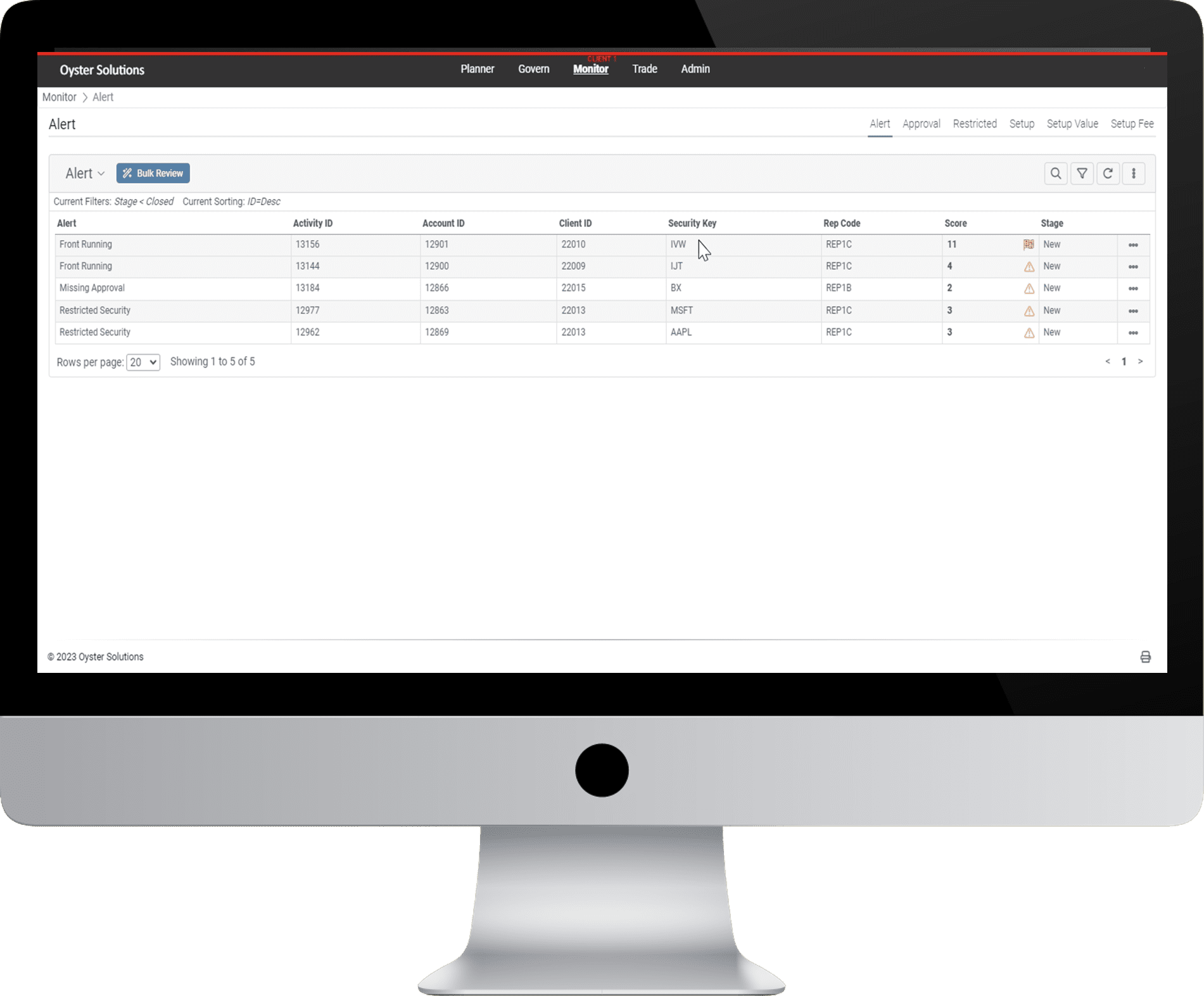

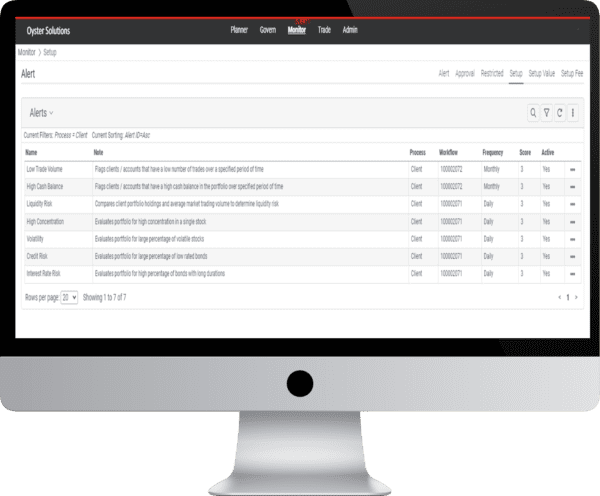

Oyster Solutions allows you to efficiently manage the surveillance, trade supervision and regulatory compliance of your client and employee trade activity. Client trade activity, investment holdings, and client profile information are compared with employee information to look for conflicts of interest, compliance parameters, and risk tolerance. The automated trade supervision tool then alerts supervisors to activity that falls outside of the firm’s customized parameters of the alert engine.

Simply powerful, Oyster Solutions’ alert engine keeps your supervision requirements focused and efficient.

Your firm needs trade compliance and supervision in an easy to use and understand dashboard. Your trade reviews will be focused on what you want supervision to focus on. With risk scoring and configurable parameters, your alerts are customized to your firms policies, procedures, and controls. Utilize the tool to constantly monitor for potential exceptions. Compare transactions, positions and fees to your client profile to keep your team ahead of potential issues. Determine and configure the frequency, severity and parameters of all of your alerts in one system. Use our online tool to keep your compliance program ready for today’s markets.

Oyster Solutions also houses information about your associated persons. Get transparency into your employee or 1099 population by keeping information in one place, where you can view employee type, supervisory hierarchy and business continuity plan information. Tracking licensing and appointments, outside business activities, conflicts of interest, assigned equipment and complaints for needed individuals is easy, reportable and configurable to your needs.

Monitor Account or Household Trade Compliance

-

-

-

-

-

-

- Account or Client Fees

- CDSCs

- Cherry Picking

- Employee Conflicts

- Liquidity

- Trading Activity

- Volatility

-

-

-

-

-

Learn how Oyster Solutions creates a modern, effective compliance program that protects your firm and provides value.

Download